For that reason, experts recommend investing only money you won't need for at least five years. Accounts that earn compound interest are often invested in the stock market, which means they carry some degree of risk. Your initial investment - your starting sum. To use our compound interest calculator, you'll need a few pieces of information:

#Compound define finance how to#

How to use a compound interest calculator Simple interest tends to be used in most student loans, mortgages, and installment loans - when you're paying a store for the purchase of a big appliance over a period of time, for example. At the end of the third year, $130 - compared to $133.10 in the compounded interest account.Įven though we've used small numbers here, you can see how the farther out you go, the more compound interest nets you - and the more it outstrips simple interest. But at the end of the second year, you'd have $120.

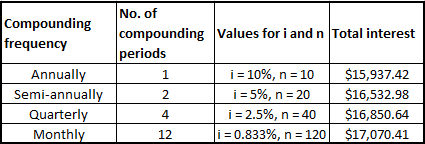

At the end of the first year, you'd have $110. That means the 10% interest rate applies only to your original principal amount of $100, so you earn $10 each year. Let's take our $100 savings account again, only this time it's paying 10% in simple interest. Simple interest is calculated only on the original principal balance or deposit. While compound interest is "interest on interest" - calculated on both the principal amount and the accumulated interest - simple interest is wholly different. On the other hand, if you're being charged interest, monthly or yearly compounding will save you money compared to daily. If you're the one earning money off the interest, daily or monthly compounding is preferable to yearly. Here's how an initial investment of $5,000 would grow if compounded semi-annually over a period of 35 years, at an annualized 5% interest rate: Over time, compounding interest can really add up. Interest can be compounded daily, monthly, quarterly, or annually, and the more frequently it's compounded, the faster it accumulates. How quickly your money grows depends on the interest rate and the frequency of compounding. In other words, with compound interest, you earn interest on previously earned interest.īecause of this, compounding interest makes the principal grow exponentially, meaning as interest accrues and the quantity of money increases, the rate of growth becomes faster. At the end of the third year, you'd have $133.10 (121 in principal + 12.10 in interest). At the end of the second year, you'd have $121 (110 in principal + 11 in interest). At the end of the first year, you'd have $110 ($100 in principal + $10 in interest).

Compound interest is a kind of interest based on adding the original principal - that is, the initial amount invested or borrowed - with the accumulated interest from previous periods.įor example, say you have $100 in a savings account, and it earns interest at a 10% rate, compounded annually. What is compound interest?Īll interest is a percentage charged on, or earned by, a lump sum of money.

That's a substantial additional cost and could make it much more difficult to pay off your balance. Even though you'd be chipping away at your balance and paying an extremely low interest rate, you could still end up paying a lot in interest charges - more than $1,000, in fact.Īnd if you were being charged 18% compounded daily - which is closer to the average credit card interest rate - you would pay $5,236 in interest after five years. You plan not to put anything else on the card, and to pay it all off in five years. In fact, the above example could be turned upside down by imagining that you carry a $10,000 balance on a credit card (we'll assume it's the same 4% compounded daily, even though credit card APRs are usually much higher). In fact, compounding is part of what makes carrying an outstanding credit card balance so costly. How compound interest can work against youĪs beneficial compounding interest can be for savings, investments, and wealth creation, it's important to note that it can work against you if you're paying off debt. This means you earned $2,213.89 in interest. That's the total amount of money you'd have in your money market account at the end of five years. The numbers you'd plug into each variable are as follows:

#Compound define finance full#

You leave that money in the CD for the full five years, and it earns a 4% annual rate of interest that's compounded daily. Let's say you decide to deposit your $10,000 annual bonus into a 5-year certificate of deposit (CD). The compound interest equation basically adds 1 to the interest rate, raises this sum to the total number of compound periods, and multiplies the result by the principal amount.

0 kommentar(er)

0 kommentar(er)